Investment property in Amed

In the realm of real estate investment, particularly in the lush, vibrant corners of the world like Amed, Bali, the question of “what ROIs can I expect from an investment property in Amed?” isn’t just a question – it’s a quest.

Amed, with its serene beaches, spectacular marine life, and relatively untouched landscapes, stands as a beacon for investors looking to merge the joy of owning a slice of paradise with the practicality of earning from it.

But as we wade into the waters of real estate investment in Amed, let’s dispense with the niceties and dive deep into what truly matters: Can your investment in a holiday home here really pay off?

The narrative around Amed has long been one of an idyllic retreat, a diver’s paradise, and more recently, a burgeoning hotspot for savvy real estate investors.

The allure is undeniable, but the financials, the cold hard numbers, are what will ultimately sway the decision for any investor.

Holiday homes and

investment property in Amed;

By reading this article, you will learn how;

- a holiday home in Amed can offer a high ROI due to its growing popularity among tourists;

- the potential ROIs for an investment property in Amed is promising due to its increasing demand and tourism growth.

- Investing in a holiday home in Amed, Bali can provide a lucrative ROI opportunity.

The real estate market in Amed

Amed, Bali, has undergone a fascinating transformation over the past few decades. Once a string of sleepy fishing villages, it has gradually morphed into a destination for those seeking tranquility away from the island’s more commercialised locales.

This unique positioning makes Amed not just a place to invest in real estate but to invest in a lifestyle, one that is increasingly sought after in a world that’s moving too fast.

Insider tip;

The key to understanding Amed's investment potential is recognising its emerging status. Unlike more developed areas, Amed offers a ground-floor opportunity.

It's the difference between entering a market that's already at its peak and one that's just beginning to climb.

ROIs from investment property in Amed

To speak of ROI, we must first lay down the metrics. In real estate, ROI is typically calculated by considering the annual rental income against the initial investment costs, including purchase price and renovation expenses.

In Amed, the average purchase price for a holiday home can vary widely based on location, amenities, and size, but let’s consider a mid-range investment for our analysis.

The rental market in Amed is buoyed by the area’s rising popularity among tourists seeking an authentic Balinese experience.

With the right property and management, annual rental yields upwards of 15% are more than achievable.

These conservative return estimates outpace many traditional investment avenues when managed effectively.

Case study;

Consider the Vesica Villas Celuke Development, an exclusive collection of homes that are expected to perform in excess of 70% per year in terms of occupancy and nightly rates.

By focusing on unique value propositions such as sustainability, luxury in simplicity, and immersive cultural experiences, properties like these not only attract a higher caliber of guest but also command a premium in the market.

Hidden real estate variables:

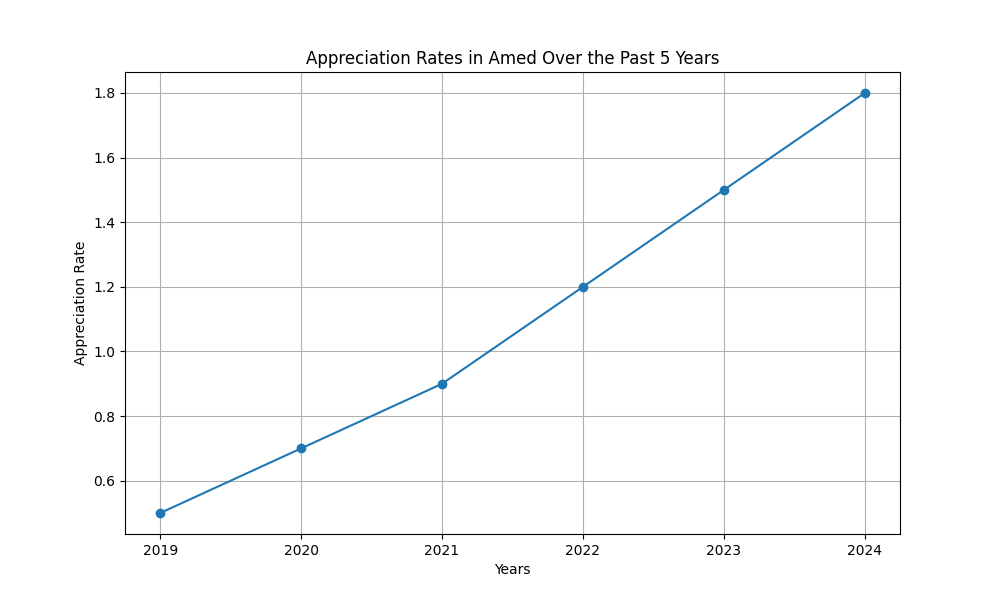

Value appreciation and market dynamics

While rental yield is a significant component of ROI, property value appreciation cannot be overlooked.

Amed’s real estate market has seen a steady appreciation, with land and property values increasing by an average of 5-10% annually over the last five years.

This trend is expected to continue, driven by ongoing infrastructure developments, increasing international interest, and Bali’s resilient appeal as a global tourist destination.

Insider tip;

Savvy real estate investors in Amed not only look at the current ROI but project the potential property value appreciation.

This is based on tangible factors such as upcoming road improvements, new tourist attractions, and government initiatives to boost tourism.

Comparative advantage:

Amed vs. Other Bali hotspots

When considering an investment in Bali, Amed offers a distinct set of advantages compared to more developed areas like Canggu, Seminyak, Sanur and Ubud.

The lower entry cost is a significant factor, providing a more accessible threshold for investors.

Additionally, the saturation of holiday homes and villas in those other areas means competition is fierce, often leading to a race to the bottom in terms of pricing.

Amed, by contrast, still retains a niche appeal. Its reputation as a diving and snorkeling paradise, combined with the laid-back, authentic vibe of the area, attracts a specific type of traveler.

These are visitors who often seek longer stays and are willing to pay a premium for the experience, translating into higher ROI for property owners.

Comparative analysis;

A study of holiday home ROI across different parts of Bali reveals that while Amed might offer a slightly slower start due to its emerging status, the long-term gains, both in terms of rental yield and property appreciation, are potentially more substantial.

Property investment challenges and how to navigate them

Investing in Amed, or any foreign real estate market, comes with its set of challenges. Legal hurdles, cultural nuances, and the logistics of managing a property from afar are significant considerations.

However, these challenges are not insurmountable. Partnering with reputable local agencies such as Vesica Villas Property Management, engaging with the community, and adopting a hands-on approach to understanding the legal landscape are all strategies that can mitigate these risks.

Insider tip;

Engage with a property management company that not only understands the local market but aligns with your vision for the property.

The right partnership can be the difference between a profitable investment and a costly lesson.

Sustainability and community engagement:

The Future of Investing in Amed

As we look toward the future, the conversation around real estate investment in places like Amed is increasingly focusing on sustainability and community engagement.

Investors who prioritise eco-friendly practices, support local economies, and foster respectful cultural exchanges are not only contributing to the preservation of Amed’s natural and cultural heritage but are also positioning themselves favourably in a market that values authenticity and responsibility.

Conclusion

The anticipated returns on investment property in Amed is a multifaceted question with an equally complex answer.

Yes, the potential for a lucrative ROI is undeniably present, bolstered by Amed’s growing appeal, favorable market dynamics, and the unique lifestyle investment it represents.

However, success in this market requires a nuanced understanding of the local landscape, a commitment to sustainability, and a strategic approach to property management.

For those willing to navigate these waters, Amed offers not just a promising investment opportunity but a chance to be part of a community that values the delicate balance between growth and preservation.

In essence, investing in Amed is not just about the financial returns; it’s about becoming a steward of a piece of paradise.