Real estate investors are looking for new opportunities in emerging property markets in Bali.

By reading this article on the Bali real estate market, you will discover;

- Information on rental occupancy rates across five tourist hotspots in Bali.

- Which rental market had the highest average revenue earned (US$) in 2023.

- Where is the Price per Day (US$) for rental properties is growing the fastest.

Bali's Real estate market in 2024

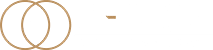

Bali’s real estate market has proven to be an investor’s dream over the past two decades. Tourist numbers have increased and property development has exploded as a result.

The influx of foreign investment has created a resilient market for property sales and holiday villa rentals in the more developed tourist resorts of Seminyak, Sanur, Canggu and Ubud.

Whilst early property investors in these areas have made life changing returns on their investments, this article provides a case that suggests the property market in the developed Southern regions has become saturated and that the growth cycle is close to its peak.

Investing in Bali real estate

The Southern part of Bali has been exposed to major levels of development as places like Sanur, Canggu and Seminyak have emerged from being sleepy towns into large scale tourist destinations.

The results for property investors have been financially outstanding. Early buyers of real estate have seen a return on the price of a property upwards of 500% in less than a decade.

That is a compounded rate of return of around of 17.5% per year. (the annual compound rate of the S&P 500 over the same period was around 12.6 % per year).

Bali's vibrant rental market

Investment returns become even more impressive when we consider that rental incomes alone can account for significant returns with an investment payback rate between 5-7 years.

High-yield rental returns have been generated through the demand created by increasing tourists numbers and longer-term expat residents. Many early property investors continue to generate incredible rental profits and still own the property structure as an underlying asset.

Real estate prices in Bali

The price of property in the most developed areas of Bali has risen exponentially since the year 2000.

So whilst the principal investment capital used to buy a property has been paid back with rental returns, property owners are also sitting on substantial equity gains in the underlying values of their properties.

Is the developed South reaching its peak?

Whilst the influx of tourists to Bali has resulted in impressive returns for landowners, property owners and businesses serving the boom towns, there are a number of negatives that are creating a shift in investor perception.

- The price of land and property is simply too high for many new investors

- Sale and rental profits are being squeezed in what is termed a ‘buyers market’

- Traffic jams and congestion in every direction

- The basic cost of living is becoming expensive. Rental prices for convenience stores and restaurants have risen in line with villa rental costs.

Property price stagnation

There comes a point in every growth cycle where the pace of growth begins to slow before rapidly stagnating.

Consumers can not continue to fuel price increases as the balance of value tips over and beyond what the consumer is willing to pay.

This applies to the cost of rent, a bag of apples and even for wasted time sitting in traffic.

Bali Property Investment Report 2024

This comprehensive Investment Report is a must read for property investors focused on the Bali real estate market.

The 54 page PDF provides a detailed insight into:

- Investor trends on growth stage real estate markets

- Rental occupancy rate performance from 2021-2023

- Comparative ROI's for 5 key tourist areas in Bali

- What type of property delivers the highest rental return

- The 18 year property cycle

Real estate market in Amed

Amed is a developing tourist destination best known for its world-class diving, laid back lifestyle and is of course, home to stunning sunsets over one of Bali’s most famous icons – Mount Agung.

If you had visited Amed during the pre-Covid days then you would remember the town for its slow pace of life and friendly local community. You would also likely remember Amed as being less developed than other resorts in the Southern part of the island.

Investors are looking at property in Amed

Whilst Amed still remains less developed than its Southern counterparts, this once sleepy fishing town is rapidly coming to life as the area begins to demonstrate clear signs of development, with a real estate market positioned at the start of an exponential growth cycle.

Amed is a town that is emerging through a period of change. From improved road and access networks, to a growing number of restaurants, to an abundance of lifestyle activities and Western style amenities.

Property investment in Amed is ramping up as early investors seek to capture the opportunity of buying land and property during the early stages of a real estate growth cycle.

Property prices in Amed

Property prices in Amed represent significant value to those found in Bali’s more developed tourist hotspots. The price of land in Amed is currently much lower than the price of land in Canggu, Uluwatu, Sanur and Ubud.

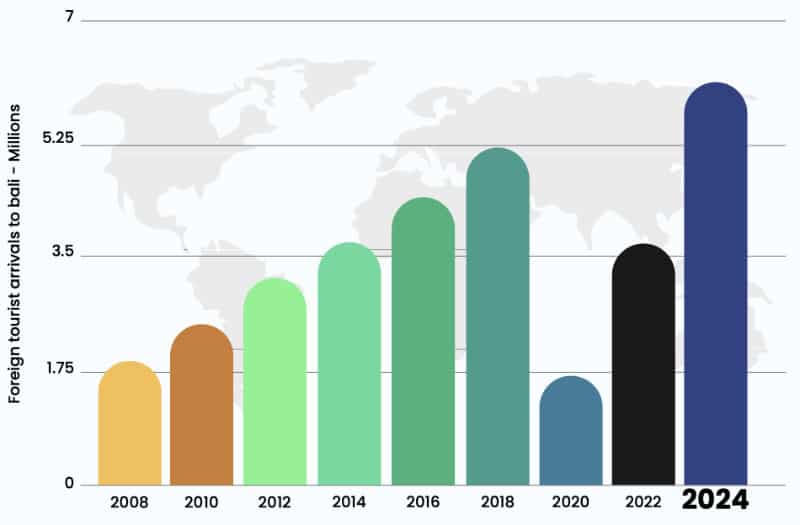

The chart below shows the price of land per are (1 are = 100sqm) in Amed over the past decade. The data has been sourced by a legal notaris through direct contact with the land tax office in Amalpura, Karengasem.

Exponential land price increases

The price of leasehold land in Amed in 2020 was Rp. 2 million per are. In 2024 the price of leasehold land is Rp. 5.5 million per are.

Representing a 175% increase in the price of land in just 4 years!

Land prices in Amed are expected to reach Rp. 8million per are by 2028. This will represent a further 65% growth from 2024’s values.

Holiday rental villas in Amed

The following information has been taken from an in-depth study into the villa rental market in Bali.

The information has been compiled through an online data resource management platform and has been assessed by leading real estate firm, CBRE, who reported the data source as being 97.5% accurate.

You can access the full 54 page property investment report for more detailed information on the Bali real estate market 2024.

LOW SUPPLY

There are 440 short-term listing properties in Amed. Of those properties only 8% have 3-bedrooms.

PRICE PER DAY

12 listings fall under the category of 'Midscale' properties (Price Per Day range US$145.00-US$300.00)

OCCUPANCY

The average occupancy rate for 3-bedroom/3-bathroom 'Midscale' villas in Amed during 2023 was 76%.

AMED

Occupancy rate for 3-bed/3-bath 'Midscale' villas from the start of 2021 to the end of 2023 increased by 88%

CANGGU

Occupancy rate for 3-bed/3-bath 'Midscale' villas from the start of 2021 to the end of 2023 increased by 31%

SEMINYAK

Occupancy rate for 3-bed/3-bath 'Midscale' villas from the start of 2021 to the end of 2023 increased by 33%

Rental Occupancy Rate Analysis in Bali

View the occupancy charts and revenue earned data for 5 key real estate markets in Bali.

The 54 page report contains rental data from 2021-2024;

- Occupancy rates from 5 key toursit hotspots

- Revenue potential ($US) and Revenue earned ($US)

- Price per Day ($US) rental averages for 3-bed/3-bath villas

- ROI comparisons

- Cost to buy a rental villa in 5 key markets in Bali

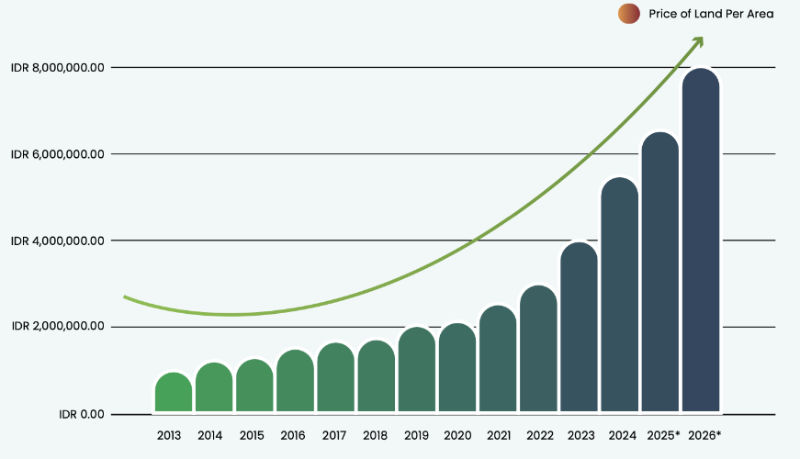

The 18 Year property cycle

The 18 year property cycle is an investment model that property investors use to identify the ups and downs of a property market in a relatively predictable pattern.

Based on long-term historical data of global real estate markets, the property cycle model provides an estimate that runs through four distinct phases that take on average 18 years to play out. As an average, some cycles will take longer to complete, other cycles will complete in less that the 18 year average.

Whilst the model refers to a ‘property’ cycle, the concept is essentially based on a ‘land’ cycle. The cost of building a house in Bali is much the same in Canggu as it is in Amed. The big difference in the price of a property is simply due to the underlying price of the land that the property occupies.

Where is Bali real estate in the 18-year property cycle?

Discover why some areas in Bali are approaching their property market peak.

Learn which real estate market is in the early stages of a 14+ year explosive phase.

The 54 page report clearly identifies why;

- Some markets are less than 2 YEARS away from the Recession Phase

- Emerging markets provide a significant margin of safety

- Early investors generate high rate ROI's for extended periods

- Generational wealth can be created in the first 14 years of a property cycle

Is it safe to invest in Bali's real estate market?

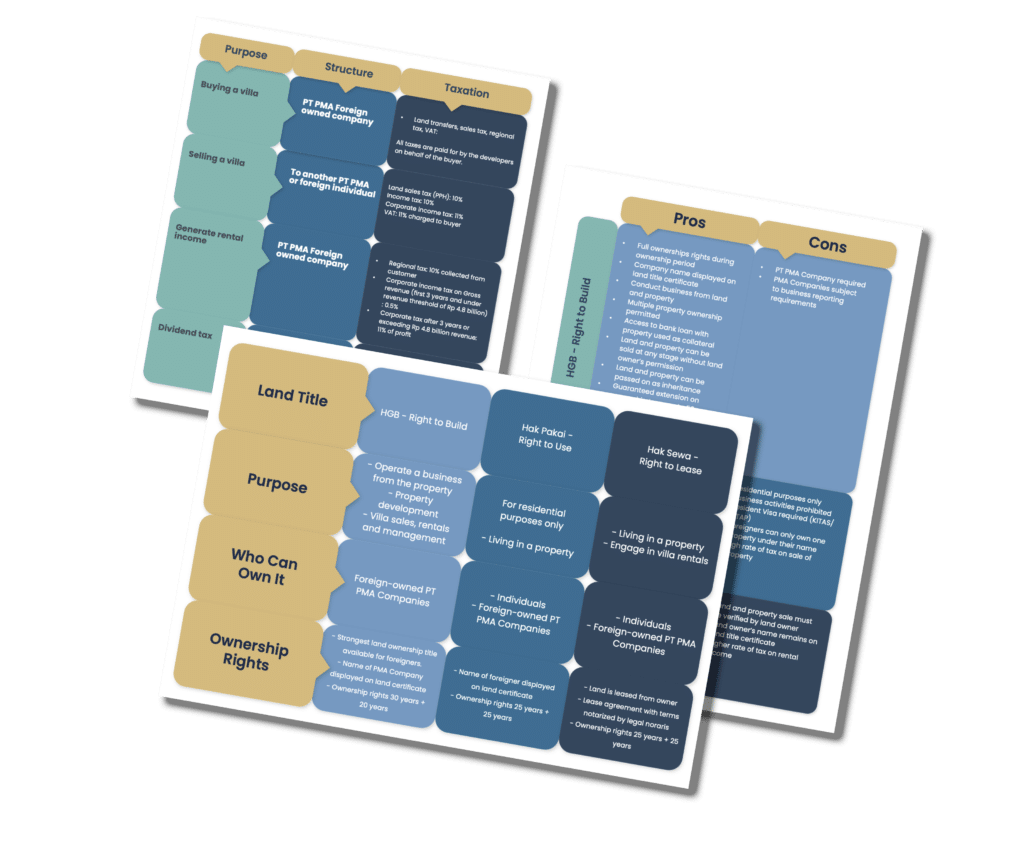

Investing in real estate throughout Indonesia has become more achievable for foreign property investors. A change in the land ownership laws now provides foreigners with a high level of security as land and property investments can be legally secured with confidence.

Property ownership laws for foreign investors

The land ownership laws of Bali can be a little confusing, however the laws are clearly laid out and allow foreigners to be legal owners of both land and property.

What may seem confusing and overwhelming at the start is in reality a fairly simple process. Once you have determined how you will use your property you can begin to structure the purchase to conform with the applicable land ownership title.

Owning property in Bali as a foreigner

The safest way for a foreigner to invest in Bali real estate can be found in this comprehensive investors report.

The 54 page report provides everything an investor needs to;

- Acquire land and property under the strongest ownership title

- Generate a tax efficient passive income from a rental property investment

- Own property with your name on the land title certificate

- Understand the tax implications of buying land and property

- Generational wealth can be created in the first 14 years of a property cycle

Luxury villas for sale in Amed

Vesica Villas Celuke is the first of its kind villa development in a prime location of Amed. The luxury villa complex is comprised of nine 2-storey villas, each with 3 ensuite bedrooms, swimming pool and large landscaped garden.

The villas have been designed to make the best use of both indoor and outdoor living spaces. Spacious interiors are furnished with high-end, modern concepts. External spaces in peaceful surroundings enjoy unobstructed daily views of the sun rising over the Bali Sea.

Property in Amed for rental investors

Vesica Villas Celuke presents property investors and long-term residents with an exceptional opportunity to own a stunning piece of Bali real estate.

Amed’s holiday villa rental market, in the Price per Day category of ‘Midscale’ villas (price range of US$145 – $US300 per day) delivered an occupancy rate of 76% in 2023.

Capturing a piece of prime real estate in Amed during the very early stages of the property cycle presents a life-changing opportunity with rental profits providing for high-rate passive incomes as property values appreciate over time.

Amed's first luxury villa development

A fully managed gated complex presenting a total property solution.

Whether for residential or investment purposes, Vesica Villas Celuke presents itself as a luxurious and sacred retreat at the heart of Amed.

Prime real estate in Amed’s growth stage market;

- 3-bed / 3-bath two-storey pool villas

- Located only minutes from Amed beach

- 75% p.a. rental occupancy rates

- Your name on land title certificate

- Ocean views of the Bali Sea